November 11, 2020

Banks continue to tighten lending standards in the face of persistent economic uncertainty. Mortgage delinquencies and foreclosures are up, but the overall health of the mortgage market is stronger than the headlines suggest. And the rent keeps getting paid at professionally managed buildings.

Lending standards tightened further in 2020's third quarter

- In Q3, the share of banks saying they tightened lending standards was, on net, 11.5 percentage points higher than those that said they loosened standards, according to the Federal Reserve.

- For-purchase mortgage applications fell week-week again, but remain 16% above last year's pace.

Don't read too much into seemingly big increases in delinquency & foreclosures

- 1.2% of loans are at least 150 days past due according to CoreLogic, and ATTOM reported that foreclosures increased 20% in October.

- The increased long-term delinquency is due to participation in forbearance programs, and foreclosures are down 80% year-over-year.

Rental payment rates continue to hold firm

- 80.4% of households living in professionally managed apartments paid at least part of their monthly rent through November 6, according to the National Multifamily Housing Council.

- That rate is just 1.1 percentage points below last year's levels and ahead of the 79.4% payment rate at this point in October.

So what?

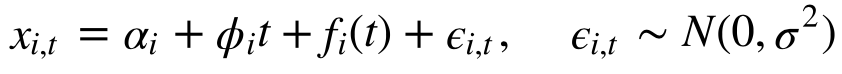

Despite the fact that many sectors of the economy experienced meaningful improvements in Q3, banks further tightened lending standards on all loan types — including mortgages — citing a still-uncertain economic outlook. The net percentage of banks applying more stringent criteria to their mortgage lending practices was far less than the net share in Q2 2020, when the difference between the share of banks tightening standards and the share loosening standards was more than 50 percentage points. Still, the Q3 reading was far above any reading prior to the pandemic. While the still-elevated level of tightening signifies that banks are being extremely cautious given the tentative economic outlook, mortgage lenders' restraint is likely also a product of demand. Mortgage rates have remained at or near all-time lows for months, something that has prompted a surge in demand both for home purchase loans and refinances. Applications for mortgages remain well above last year's levels, as well as levels from the past several years, even as purchase loan applications have slipped recently compared to prior weeks.

Mortgage delinquencies and foreclosures increased in August and October, respectively, but those increases likely exaggerate any claims that the mortgage market is broadly unhealthy — though the data do point to some looming challenges for the market. CoreLogic's measure of "extremely delinquent" loans – those at least 150 days past due – reached its highest level ever in August, twice where it was in January 2010 at the height of the Global Financial Crisis. But the uptick is driven by widespread participation in mortgage forbearance programs, and encouragingly, the share of loans delinquent between 30-and-59 days fell year-over-year. The uptick in foreclosures was maybe more surprising, given participation in forbearance programs, but the notable monthly increase fails to account for the bigger picture. Even though foreclosures increased 20% in October from September, they remain down almost 80% year-over-year. Foreclosure activity remains very low overall, though an increase of some kind should be expected if/when forbearance programs expire in 2021. What impact that will have on the housing market remains to be seen, but early indications suggest that government support and high levels of accumulated home equity should dampen the impact.

The share of households living in professionally managed apartment properties who made a November rent payment in the first week of the month fell slightly from last year's rate but not alarmingly so, continuing a trend that has played out since the early spring. The 1.1 percentage point difference in payment rates through November 6 2020 and 2019 was notably smaller than the annual differences recorded in the summer months. That said, the more-or-less steady payment rate may be masking some underlying issues plaguing the broader rental market. The report doesn't identify what share of the 80.4% of households that made a payment only paid part of their rent and/or were only able to stay current because of an accommodative arrangement made by their landlord that may require larger payments down the road. Additionally, this report only examines payment rates in larger, professionally managed rental properties which, in some cases, may have a larger financial buffer than landlords of smaller operations. Lastly, people's ongoing ability to make rent may fade going forward as savings generated from direct stimulus checks and other measures earlier in the year start to dwindle. Still, the fact that a key measure of rental rates hasn't plummeted is obviously a good sign for the state of the housing market.

Click here to read past editions of Zillow’s Market Pulse updates.

The post Zillow Market Pulse: November 11, 2020 appeared first on Zillow Research.

via Zillow Market Pulse: November 11, 2020