- Markets smack in the middle of the so-called "Silicon Prairie" – including Kansas City and Oklahoma City – top the list of those that may appeal to growing tech companies, followed by markets in the Midwest and the South that have the ability to draw talent and the tech companies looking to hire them.

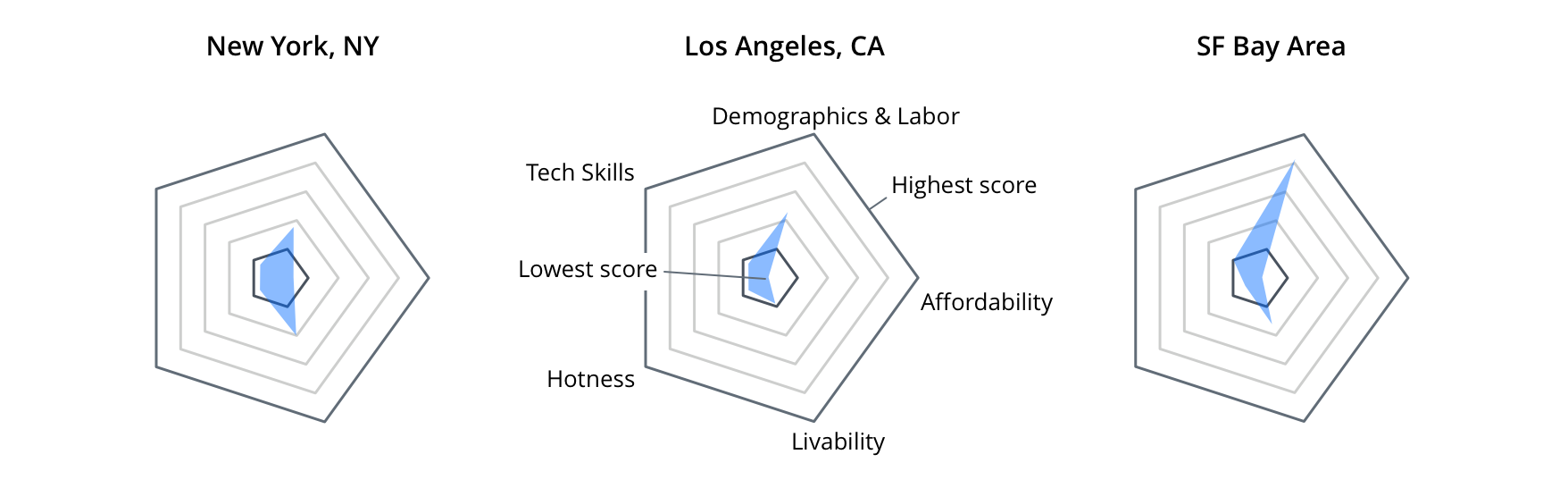

- Eroding affordability and relatively lackluster quality of life put the nation's more-stereotypical tech hubs – the San Francisco Bay Area, Seattle and/or New York – at or near the bottom of the rankings.

Widely recognized tech hubs including the San Francisco Bay Area and Seattle are no longer the obvious spots for large tech companies to expand and/or for new startups to set up shop. Rapid housing cost growth in these areas and a saturation of firms competing over limited pools of tech talent may instead push tech companies to shift their gazes elsewhere.

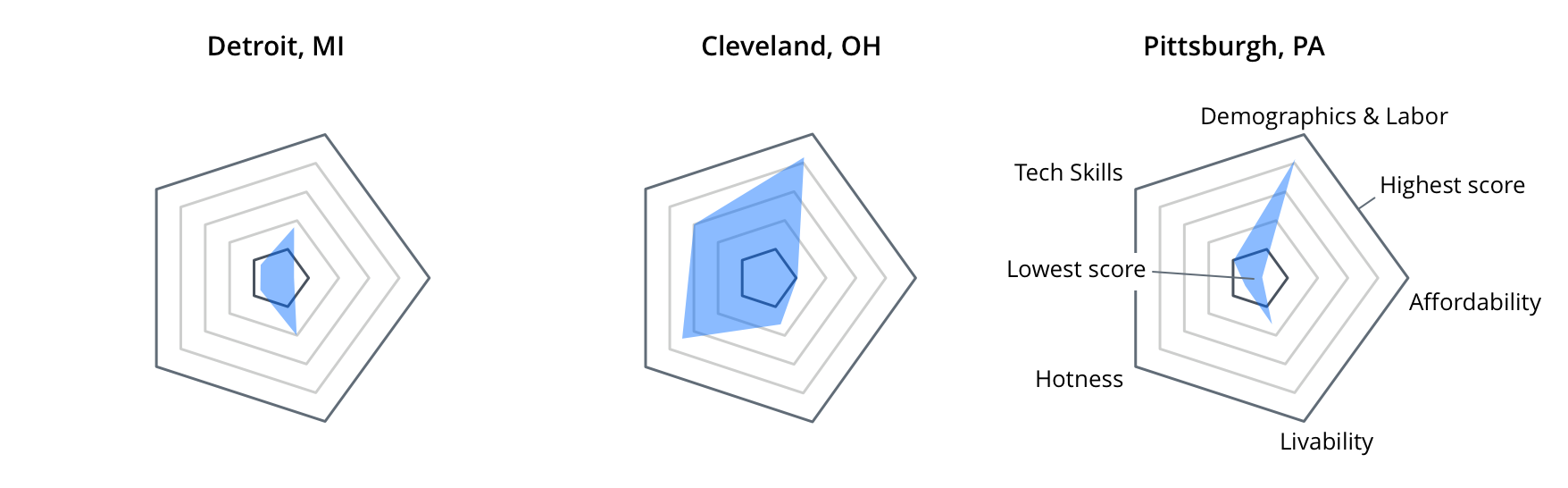

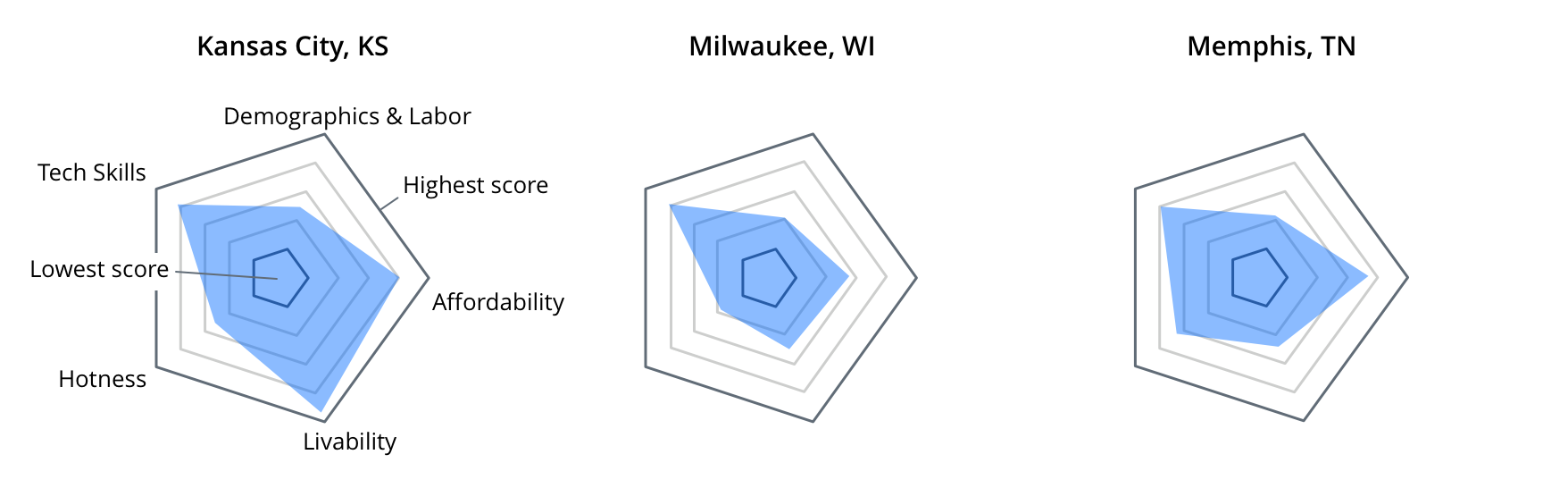

Zillow analyzed market conditions in 42 large metro areas nationwide, focusing on five factors that could suggest a market ripe for tech growth:

- housing affordability

- market 'hotness' – factors indicating a market has the potential to attract people

- demographics and labor market dynamics – factors that indicate a robust local economy

- tech availability – factors that indicate a market has less competition for talent

- livability – factors that highlight the appeal of living in a given market

Surprisingly, the markets offering the best balance between these five dimensions are not necessarily those that may be top-of-mind when asked to identify tech hot spots. Markets smack in the middle of the so-called "Silicon Prairie" top the list of those that may appeal to growing tech companies, followed by markets in the Midwest and the South that have the ability to draw talent and the tech companies looking to hire them. Eroding affordability and relatively lackluster quality of life put the nation's more-stereotypical tech hubs at or near the bottom of the rankings.

Oklahoma City and Kansas City lead the list of markets that may be appealing to tech initiatives. These cities rank high in housing affordability: In each, those earning the area's median incomes should expect to spend a comparatively smaller share of their income on housing. They also earn high marks for livability (Kansas City tops the list in this category) and the local availability of workers with in-demand tech skills.

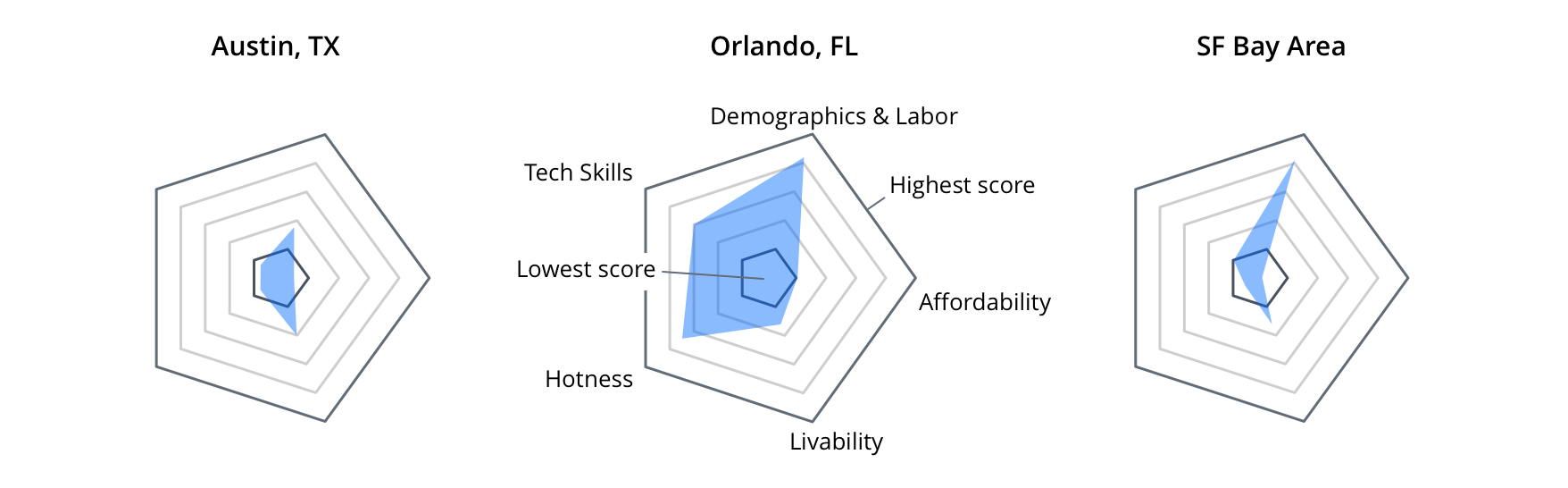

A number of southern markets, including Jacksonville, San Antonio and Austin, as well as Cincinnati, rank among the top 10 in terms of market hotness. Robust rent and/or home value growth, as well as more people from outside the areas looking in instead of people already there looking out, suggest these places are poised for continued growth and an influx of people.

Traditional tech hubs – along with Chicago, not typically considered a tech hotspot – occupied all of the bottom five slots on the ranking. Lack of affordability is a major, unifying concern for tech hubs: Los Angeles and the Bay Area have the worst affordability rankings of all markets examined in this study.

Below, we've highlighted some standouts from each of the five dimensions we examined.

Affordable Markets

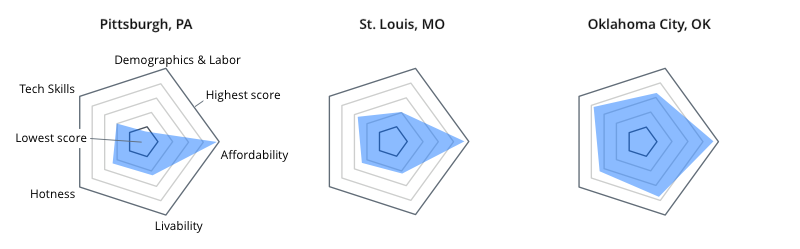

In recent years, a handful of tech-dominant markets have become notoriously unaffordable for both the average wage earners and even some traditionally higher-paid workers, like computer programmers. Areas with better affordability – where renters or home buyers can expect to spend less of their income on housing – offer both a lower barrier for newcomers and ensure that current talent can stick around. Topping the list of affordable markets are Pittsburgh, St. Louis and Oklahoma City.

On the flip side, some markets in California are prohibitively expensive. In Los Angeles, for example, a renting household earning the area's median income should expect to spend almost half of their income on a middle-of-the-road rental. In San Diego, the same renter should expect to pay almost 40% of their income on the local median rent. Mortgage affordability in these pricey places is also abysmal. In the San Francisco Bay Area, the average person would need to spend 40 percent of their income on a monthly mortgage payment – and that's after assuming they have $200,000 on hand to use as a 20% down payment on the area's median home, which costs only a cool $1 million.

Hot Markets

"Market hotness" measures the potential of a given market to both retain locals and appear as an attractive destination for others. Healthy rent and home value growth, coupled with a higher share of more people searching in than out, point to a market with staying power. Las Vegas, Jacksonville and Tampa have the highest inbound-to-outbound home search ratios of all the markets studied. Combined with some of the strongest home value and rent growth, these markets are the hottest around.

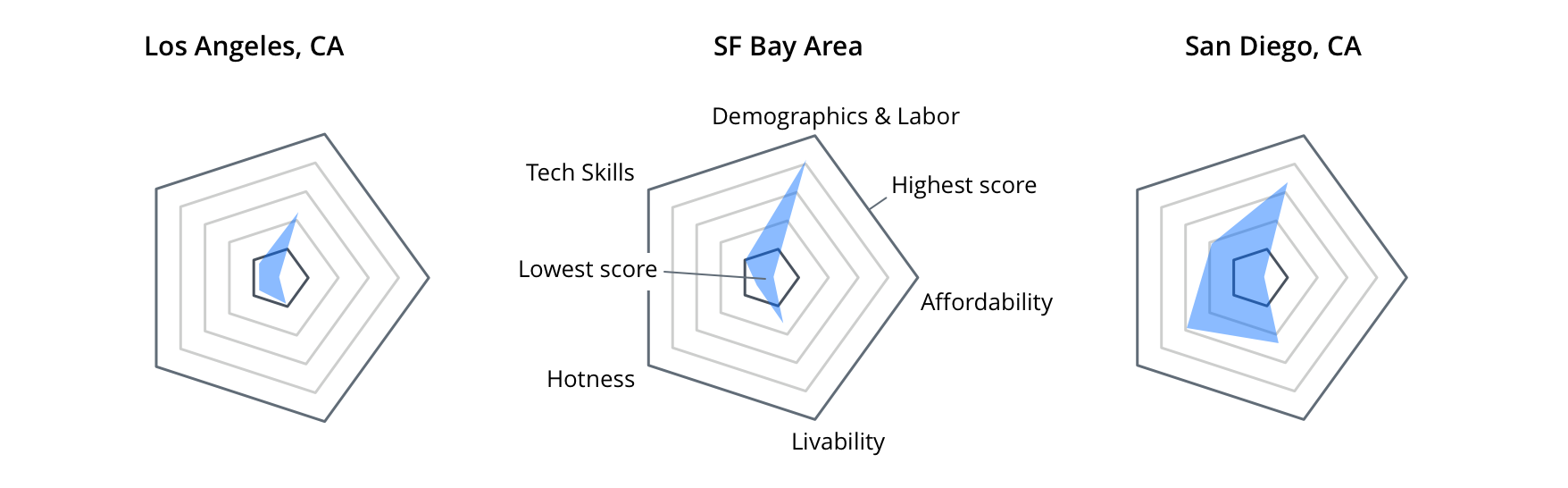

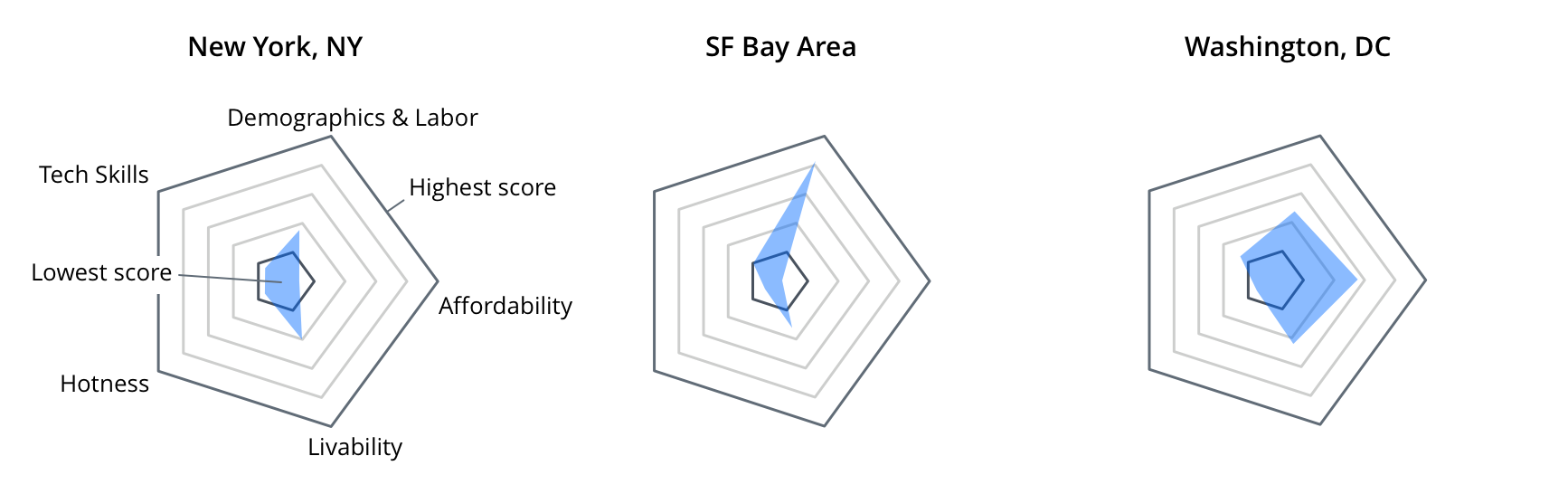

The coolest markets are those where more people are looking to leave than come. The San Francisco Bay Area, Washington D.C. and New York have between four to five people searching for homes outside of the market for every one looking from the outside in. The San Francisco Bay Area, in particular, is the only market on this list that experienced falling home values over the past year – likely because of mounting housing affordability challenges in the face of unsustainable growth.

Labor-Ready Markets

Markets that can support a robust economy with a ready supply of workers include Austin, Orlando and the San Francisco Bay Area. These areas are notable for their low unemployment rates, strong job growth and large share of the population aged 20-to-35 – an indicator of a ready supply of entry-level and middle-management workers that can grow in their roles and help a new company or office thrive over the next several years. This isn't to say that middle-aged.mid-career workers aren't valuable or necessary, only that younger workers are a good proxy for determining the potential for "early career" workers likely to enable company growth. We fully acknowledge that older workers can also start and grow in new careers, too.

On the other end of the spectrum, markets including Detroit and Cleveland have sluggish employment growth and the highest levels of unemployment of all markets on this list. Pittsburgh, another market occupying one of the lowest spots on this sub-list, has among the lowest shares of residents between the ages of 20-to-35.

Tech-Available Markets

In addition to a labor market that can support a growing economy, tech companies specifically look for markets that have access to tech skills. We partnered with LinkedIn and examined their skills gap data to identify areas with a relative shortage or abundance of workers with specialized tech talents, focusing on the core tech skills of software development, artificial intelligence and data science. Another measure of potential tech talent is the local share of residents over the age of 25 that have a bachelor's degree. Markets that scored high on this list – including Kansas City and Milwaukee – had the smallest tech skills shortage (e.g. we didn't observe markets with a surplus of tech skills) and/or relatively high shares of people with bachelor's degrees.

All the markets that scored low on tech availability had massive skills gaps in core tech skills. Demand clearly outstrips supply for tech workers in New York, Los Angeles and San Francisco. Additionally, Los Angeles and San Francisco were among the least affordable markets, so tech companies will likely have to pay top dollar for scarce talent – a tough proposition for cash-strapped startups or those looking at pricey expansions.

Livable Markets

In addition to what appeals to tech companies themselves, their employees must also find good reason to call a place home. Kansas City and Salt Lake City feature some of the shortest commutes of the markets examined, which is likely to appeal to workers of all stripes. And based on internet speed data from our partners at Ookla, Kansas City and Raleigh also have blazing-fast broadband speeds, a great amenity for local residents.

Meanwhile, Chicago has some of the longest commutes of all the markets examined, and Detroit experiences sluggish broadband speeds.

Methodology

To determine the best markets that provide the best environments for tech expansion or start-ups, we examined a number of factors that would attract tech companies and help retain tech talent:

Demographics and the labor market

- Non-farm job growth (Bureau of Labor Statistics, Current Employment Survey)

- Unemployment rate (Bureau of Labor Statistics, Local Area Unemployment Survey)

- Share of population aged 20 to 35 (U.S. Census, American Community Survey), as a proxy for early career workers. We acknowledge that older workers can also start new careers and grow into them over many years, as well.

Tech skills

- Share of population with a bachelor's degree, over the age of 25 (U.S. Census, American Community Survey)

- Shortage/surplus headcount of those with Software Development skills (LinkedIn)

- Shortage/surplus headcount of those with Data Science skills (LinkedIn)

- Shortage/surplus headcount of those with Artificial Intelligence skills (LinkedIn)

Market 'Hotness'

- Year-over-year growth in home values (Zillow)

- Year-over-year growth in rent estimates (Zillow)

- Inbound-outbound home search ratio (Zillow)

Housing Affordability

- Share of median income needed to pay median rent (Zillow)

- Share of median income needed to pay median mortgage payment (Zillow)

Livability

- Broadband speed, mbps upload (Ookla)

- Broadband speed, mbps download (Ookla)

- Mean commute time for workers that do not work from home (U.S. Census, American Community Survey)

Markets are identified by their larger metropolitan areas. The San Francisco Bay Area includes both San Francisco and San Jose metros. The underlying factors for this region are based on a population weighted average between the two metros

The post Why The Most Favorable Markets for Tech Expansion Aren't Where You Might Think appeared first on Zillow Research.

via Why The Most Favorable Markets for Tech Expansion Aren't Where You Might Think

No comments:

Post a Comment