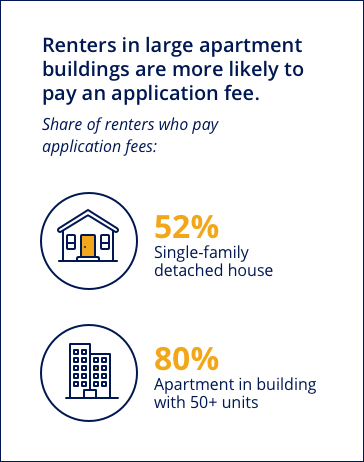

- Renters in large apartment complexes are more likely to pay an application fee than those looking to rent a single-family home.

- 71% of renters in Western U.S. markets report paying an application fee, compared to 68% in the South, 56% in the Midwest and 54% in the Northeast.

- When controlling for age, income, home type, urbanicity, and region, LGBTQ+ renters are more than 1.4 times as likely to pay an application fee. Renters of color are more than twice as likely.

Renting a home typically allows for more lifestyle flexibility – it makes it easier for households to move on short notice for new career opportunities, for example, while avoiding the commitment of a monthly mortgage payment and/or the sometimes hefty costs of selling a home. But while roughly a third (32%) of tenants that say they plan to continue renting said they'll do so because they want the ability to move easily as life changes, that flexibility isn't free.

Renters routinely pay upfront costs when applying for and moving into a rental, according to an analysis of data from the 2019 Zillow Group Consumer Housing Trends Report.[1] Among the most common upfront costs faced by renters are application fees and security deposits – 87% of renters pay a security deposit, and 64% pay an application fee. Among all renters, the typical security deposit paid is $600, and the typical application fee is $50.

But not all groups of renters feel these costs equally. Those upfront fees – and the odds they'll be required at all – vary significantly by what type of home a renter is seeking and where it is. And the renter's age, race and/or sexual orientation is also correlated with wide differences in costs.

Renters in Single-Family Homes Trade Applications for Bigger Deposits

Renters in large, multifamily buildings (with 50 units or more), for example, are much more likely to be required to pay an application fee than renters of single-family, detached homes: 80% of large, multifamily renters are required to pay an application fee, compared to 52% of single-family renters. But while single-family renters have a better chance than tenants in large apartment buildings of avoiding an application fee, their bill can come due when it comes time to pony up a security deposit. Almost 4 in 10 single-family renters (39%) said they paid a security deposit of at least $1000, with the typical deposit on such a home totaling $850. Multifamily renters that put down a deposit typically pay only $500.

Location, Location

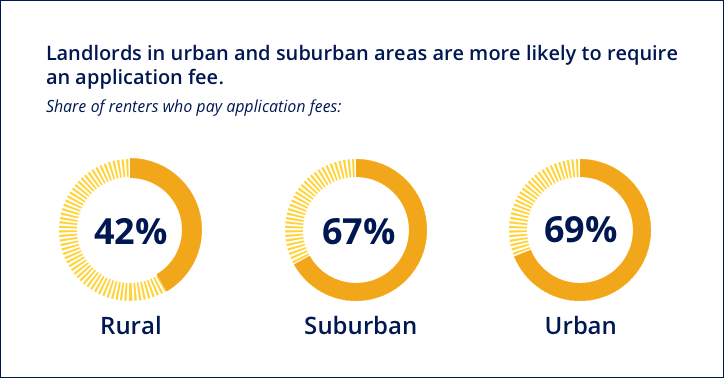

Application fees are also more or less common depending on where a rental property is located. Landlords in urban and suburban areas typically require their tenants to pay an application fee at similar rates – 69% of urban renters pay an application fee, along with 67% of suburban renters. But less than half of rural renters – just 42% – report paying an application fee. This may be a response to the more competitive rental markets in cities and suburbs, with landlords looking to applications as a way of deciding between more applicants. Security deposits are also more commonly required in urban and suburban locales: 87% and 89% of urban and suburban renters, respectively, are required to pay a security deposit, compared to 78% of rural renters.

And just as the area of town where a rental is located seems to matter when determining if an application fee is demanded, so too does the area of the country. Almost three-quarters – 71% — of renters in Western U.S. markets report paying an application fee, similar to about two-thirds (68%) of those in the South. Renters in the Northeast and Midwest are much less likely to be charged an application fee, with just over half of renters in each region (54% and 56%, respectively) required to do so.

LGBTQ+ & Renters of Color Disproportionately Impacted

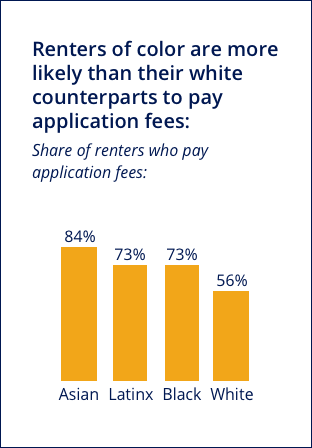

Application fees also seem to impact racial minorities more heavily: 56% of white renters pay one, compared to 73% of Latinx and black renters, and 84% of Asian renters, according to the analysis. When controlling for urbanicity (renters of color are more likely to live in urban markets), the disparity persists: 64% of urban white renters pay an application fee, a far lower share than their black (72%), Latinx (73%) and Asian (80%) peers.

Application fees also seem to impact racial minorities more heavily: 56% of white renters pay one, compared to 73% of Latinx and black renters, and 84% of Asian renters, according to the analysis. When controlling for urbanicity (renters of color are more likely to live in urban markets), the disparity persists: 64% of urban white renters pay an application fee, a far lower share than their black (72%), Latinx (73%) and Asian (80%) peers.

Similarly, LGBTQ+ identity also seems correlated with the probability that a tenant will be required to pay an application fee: Less than two-thirds (63%) of cisgender[2], heterosexual renters pay an application fee of some kind, compared to almost three-quarters (73%) of LGBTQ+ renters. When controlling for age, income, home type, urbanicity, and region, LGBTQ+ renters are more than 1.4 times as likely to pay an application fee. Renters of color are more than twice as likely.

Age is More than a Number

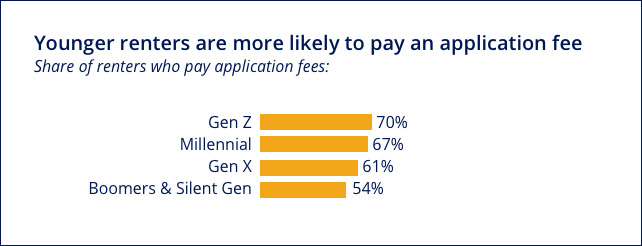

Finally, age can also bring some advantages to the seasoned renter – the odds of being asked to pay an application fee get progressively lower depending which generation a renter belongs to. Among Generation Z, the youngest generation studied, 70% of renters pay an application fee. Roughly two-thirds of millennials (67%) and 61% of Gen X renters pay one. Only a little more than half (54%) of renters from the two oldest generations, boomers and silent generation, pay an application fee. These differences may be because older renters have a longer, potentially more reliable rental history that may lessen the need for a more formal application process.

[1] The 2019 Zillow Group Report on Consumer Housing Trends is the 4th annual largest-ever survey of U.S. home buyers, sellers, owners and renters. It asked 13,000 U.S. household decision makers aged 18 and older about their homes – how they search for them, pay for them, maintain and improve them, and what aspirations and challenges drive their decision. More data and methodology specific to the 2019 report can be found here.

[2] Cisgender refers to people whose gender identity corresponds to the sex assigned at birth

The post Where and Why the Upfront Costs of Renting Differ So Widely appeared first on Zillow Research.

via Where and Why the Upfront Costs of Renting Differ So Widely

No comments:

Post a Comment