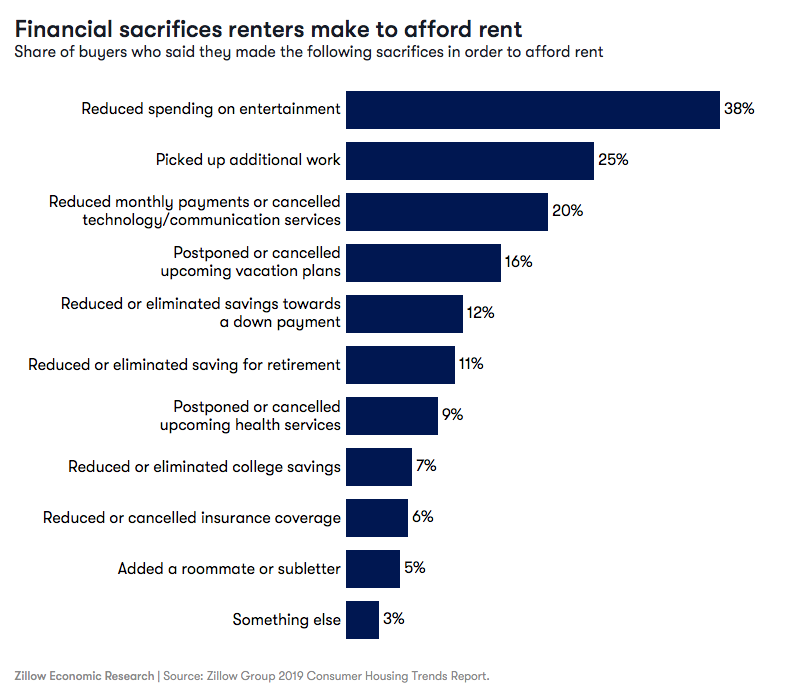

- 26% of renters say that affording their rent is difficult or very difficult – and 66% make at least one sacrifice to afford their rent.

- The most common renter sacrifices are reducing spending on entertainment (38%) and picking up additional work (25%).

- A smaller percentage of renters make more serious sacrifices to afford their rent: 9% report postponing or cancelling health services and 11% reduce or eliminate saving for retirement.

The U.S. median rent now consumes 27.8% of the country's median income – nearing the 30% tipping point above which rent is considered unaffordable and the 32% tipping point above which communities can expect a more rapid increase in homelessness.

What that looks like at the individual renter[1] level is sacrifice: According to the 2019 Zillow Consumer Housing Trends Report, most renters (66%) make at least one sacrifice to afford their rent, from reducing spending on entertainment (38%) to cutting back on insurance coverage (6%).

Renters that go over budget are even more likely to make sacrifices: 80% make at least one. Out West, where rental markets are more competitive, renters are more likely to postpone or cancel health services (13%) and trim their savings towards a down payment (16%) than renters as a whole (xx% and xx%, respectively).

Younger renters make more sacrifices

Younger renters are more likely to report a financial sacrifice to afford their rent: 75% of Gen Z renters report making at least one sacrifice, as do 69% of millennial renters – both higher than 60% of Gen X and 53% of boomer and silent generation renters. Younger renters also are more likely to pick up additional work, like more hours or taking on an additional job: 30% of Gen Z, 28% of Millennial and 22% of Gen X renters report doing so, compared to only 13% of boomer and silent generation renters.

Despite making more sacrifices than their older counterparts, Gen Z renters are less likely to say that affording their rent is difficult or very difficult: only 18% say so, compared to 28% of millennial and Gen X renters and 29% of boomer and silent generation renters. This gap may be because 20% of Gen Z renters report getting help with their rent from parents or another family member.

Renting parents make tradeoffs

Having children at home makes a big difference when it comes to financial sacrifices: 70% of renters with children at home report making sacrifices, compared to 59% of renters without children. They're more likely to pick up additional work (28%), reduce monthly payments or technology services (23%), and cut savings toward a down payment (13%), college savings (9%) and insurance coverage (7%).

Living closer to the edge than homeowners

Sacrifices aside, renters are financially strapped enough that only 51% say they could accommodate a $1,000 expense, compared to 80% of homeowners. Older renters are less likely to say they could afford such an expense: Only 38% of boomer and silent generation renters, compared to 60% of Gen Z and 54% of Millennial renters.

The trend is reversed for homeowners: 83% of boomer and silent generation homeowners say they could afford the expense, compared to 73% of gen z and millennial homeowners. It's no surprise, then, that the typical homeowner earns $75,000[2] a year in household income, double the typical $37,500 for a renter.

[1] Renters refer to households that moved in the past year and rent their home

[2] Zillow analysis of the U.S. Census Bureau, American Community Survey, 2017.

The post Sacrifices People Make to Afford the Rent appeared first on Zillow Research.

via Sacrifices People Make to Afford the Rent

No comments:

Post a Comment