- Unemployment claims for women were up 1,368% year-over-year at the height of the recession in May, 10 times higher than what men experienced in the 2008 financial crisis.

- Women are more likely to be renters, the group hit hardest by this recession. Almost half (45%) of female renter households are cost-burdened.

- With schools going virtual and child care centers closed, working mothers were three times more likely than working fathers to cite child care as the main reason they were out of work.

2020 had the makings of a promising year for women — until COVID-19 broke it. Today, women are more likely than men to be unemployed, renters and caregivers as the pandemic grinds on, increasing their risk of becoming severely cost-burdened by housing.

The year began with more women in the workforce than ever before, women's incomes rising and the home values of women-headed households on the upswing. But the pandemic swiftly and thoroughly interrupted this period of growth — 865,000 women left the workforce in September alone, fully 80% of all workers that left the workforce last month. The hard-won housing and employment progress of the past few years has definitively stalled, and in some respects is at great risk of rapidly reversing, according to a Zillow analysis of employment, housing and social data.

Our analysis found that more women than men say they are housing insecure, that women are sacrificing work hours in order to shoulder more of the burden at home and that year-over-year growth in unemployment claims among those still in the workforce is up to 10 times higher than what it was for men during the worst of the Great Recession. It will be a long road back to where women started the year.

Good News, With a Catch

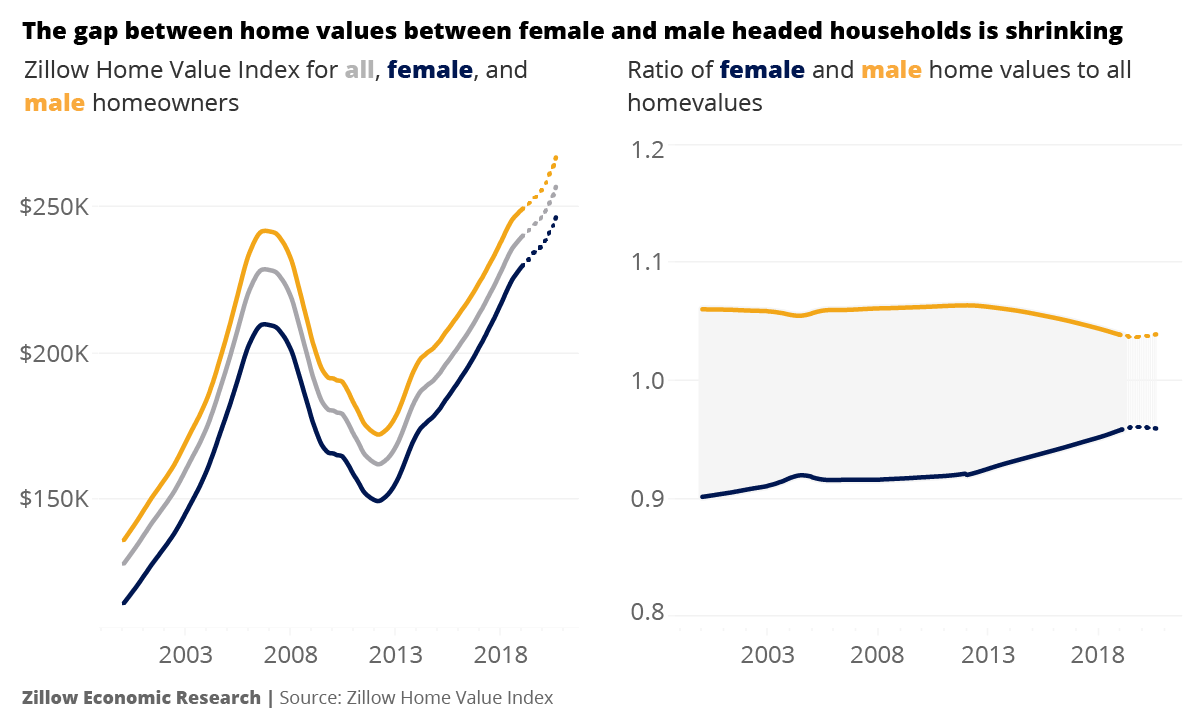

First, the good news: The homes owned by female-headed households, while still below the value of those owned by male-headed households and of median home values overall, crept closer to parity over the past decade. In August 2010, the typical home of a female-headed, homeowning household was worth 91.9% of the typical U.S. home overall, about $160,558 compared to $174,640. Today, that gap is much narrower, at 95.9% ($246,222 vs $256,663). A growing share of the workforce being made up of women, and a rise in women's incomes over the same period, are likely contributing to this progress.

Even so, the flip side of this equation says that homes owned by women-headed households are still worth 4.1% less than the typical home overall — to say nothing of homes owned by male-headed households. The typical home owned by a male-headed household in August 2020 was worth $266,716, compared to $246,222 for women-headed households. Put another way, the typical female-headed household owns a home worth just 92.3% that of their male peers.

"He-Cession," "She-Cession"

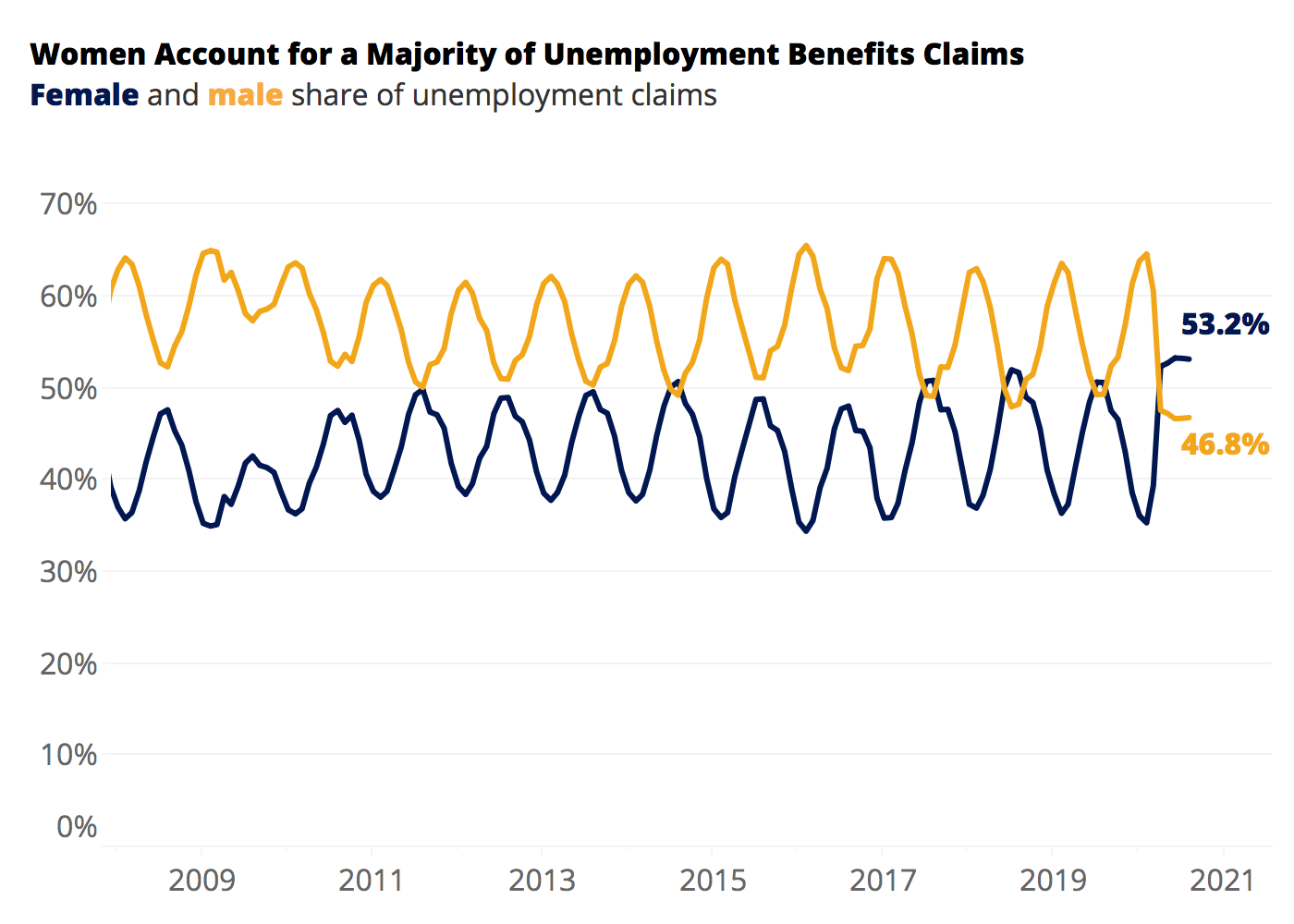

The 2008 Great Recession has sometimes been dubbed the "he-cession" for its deep impacts on traditionally male-dominant industries including finance and construction. At its worst in 2009, the year-over year change in unemployment claims for men peaked at 137%. But as bad as that was, the nation has experienced extreme levels of unemployment since the U.S. COVID outbreak began in earnest in early spring, and workers in the most affected industries have suffered serious blows to their income and job security that make the Great Recession look minor in comparison. The peak year-over-year change in unemployment claims for men during this recession is 983%.

But because women are more likely than men to work in the industries hardest-hit by the pandemic, the unprecedented surge in unemployment is impacting them far more severely. In May 2020, arguably the peak of pandemic-related job losses and business activity freezes thus far, the year-over-year change in unemployment claims for women was 1,368% — ten times higher than the worst increase experienced by men more than a decade ago.

Women in general make up a smaller share of the labor force (47.3% in 2018) than men — but they accounted for the majority of unemployment claims in July. Because of cyclical and seasonal employment trends, this pattern of outsized unemployment claims for the female workforce was already in play pre-COVID, and can be explained in part by differences between men and women in the industries in which they work. In 2018, more than 22.5% of women but only 5.7% of men were employed in healthcare, a field in which unemployment tends to spike every July. The data show that more women have been joining the workforce each year, which is undeniably a good thing. But clearly there's a lot of work left to be done to ensure women are more equally represented across all industries, not relatively concentrated in those that tend to experience more-volatile and disproportionate unemployment claims, even in more "normal" times.

Based on these data alone, the current crisis has seemingly more than earned a "she-cession" moniker (a term reportedly coined by labor economist Armine Yalnizyan). Sadly, there are still more unequal repercussions for women in this moment.

Unequal Rent Burdens

Previous Zillow research showed that renters have been disproportionately impacted by the recession — and the share of female-headed households that are renters (37.3%) is higher than male-headed renter households (31.2%), according to an analysis of data from the American Community Survey. And female renters must devote a larger share of their monthly budget to rent than their male peers. The typical female-headed renter household spends 27.5% of its income on rent, compared to 23.3% for similar male-headed households.

Rent is also more of a burden for female-headed renter households. A household is considered housing burdened when it spends more than 30% of its income on housing costs. Almost half (45.4%) of renter households headed by a female spend enough to exceed this threshold and are housing burdened, compared to roughly a third (36.1%) of male-headed renter households. The threshold for "severely" housing burdened is met when a household spends more than half of its income on housing — almost a quarter (24%) of female-headed renter households fit this definition, versus just 17% of similar male-headed households.

The impact is even more stark across races: Women of color are even more likely to be cost-burdened by housing. More than half (51%) of Latinx female renter households and 49 percent of Black female renter households are cost-burdened. More than a quarter (27%) of both Latinx and Black female renter households are severely cost-burdened. Any loss of income, even temporarily, puts these cost-burdened renter households at greater risk of housing insecurity.

A Childcare Challenge

The burden of childcare also weighs more heavily on women than men, perhaps in part because of social and cultural pressures traditionally placed more on women's shoulders to be the primary caretakers in their households. In a recent Census Bureau survey, working mothers were three times more likely than working fathers to cite childcare as the main reason they were out of work (22.1% versus 7.7%, respectively). There is also the fact that significantly more female-headed households in general are led by single-parents — a whopping 70.7% of mothers who are rental household heads are single-parents, compared to 32.3% of renting fathers.

Short-Term & Long-Term Solutions

Clearly, this triple threat of women being disproportionately employed in industries more likely to experience pandemic-related layoffs, facing higher rent burdens and of being the main family caregiver has set working women back — an understatement, to be sure. The challenges to even get back to pre-pandemic par levels, let alone to resume forward progress, are immense. But there are some broad steps that could be taken to help start the process.

Bolstering existing unemployment assistance, especially in the wake of the expiration of enhanced but temporary federal benefits earlier this summer, would go a long way towards keeping all temporarily unemployed workers — male and female — afloat until more work opportunities come along. The boost could be bigger for women, though, given the facts that more women than men are receiving unemployment benefits and more women are out of work to care for their families. Still, because hundreds of thousands of women have left the workforce, enhanced unemployment aid likely won't reach them, and more steps will need to be taken.

Because a disproportionate share of rental households are headed by women, and many of those households are rent burdened, rental assistance is another way to help women rebound from this recession. Short-term rental payment assistance may be necessary to help keep a roof over these women's heads for the time being. But longer-term solutions including increased voucher availability and the creation of more housing at more-affordable price points will also be vital to ensuring gender equity in housing and allowing more women — and men — to stay in their homes.

Methodology

Zillow analyzed 1-year American Community Survey (ACS) data from 2012 – 2018 to get demographic data about households and individual householders by tenure type and sex.

Additionally, US Department of Labor data on unemployment claims from August 2020 was used to get number of unemployment claims and share of unemployment claims by sex. The data for share of claims was used both seasonally adjusted and non-seasonally adjusted (raw) to show both the cyclical nature of unemployment claims as well as the seasonal adjustment that still shows more women than men claiming unemployment during the she-cession.

Zillow also utilized the weekly U.S. Census Bureau's Household Pulse Survey data from April 23rd – July 21st to find the share of working parents out of work due to childcare responsibilities.

The Zillow Home Value Index by Sex was calculated using county level ratios of home values by sex of householder from 1-year ACS data from 2005-2018. The ratios were constructed using population weighted geometric means and interpolated to get a monthly metric. This was then extrapolated to August 2020. The ratio of home values was then applied to monthly ZHVI at the county level. Aggregated national and metro values were obtained by taking a population weighted mean of county month-over-month changes by sex. The historical values were chained back from the latest home value ratios using the aggregated month-over-month values and then adjusted for county missingness to be directly comparable to overall ZHVI.

The post Women More Likely to Face Housing Insecurity in Pandemic-Led Recession appeared first on Zillow Research.

via Women More Likely to Face Housing Insecurity in Pandemic-Led Recession

No comments:

Post a Comment