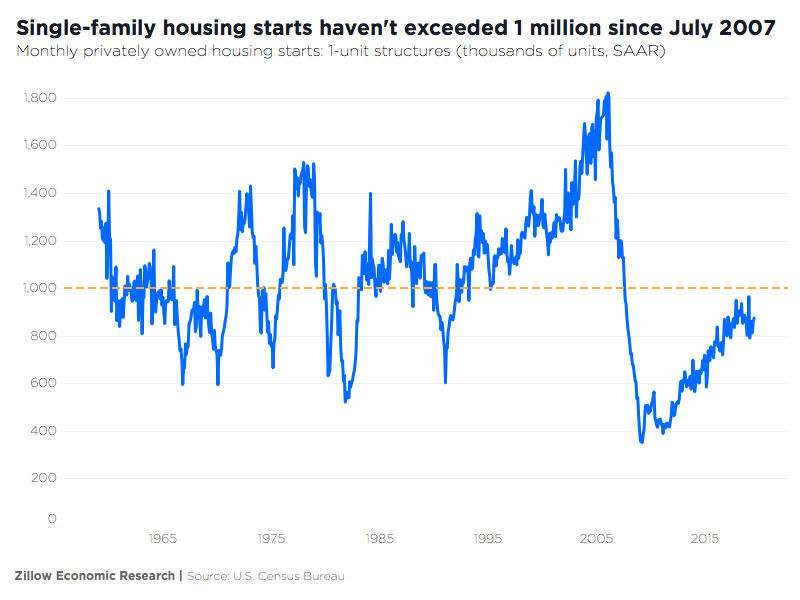

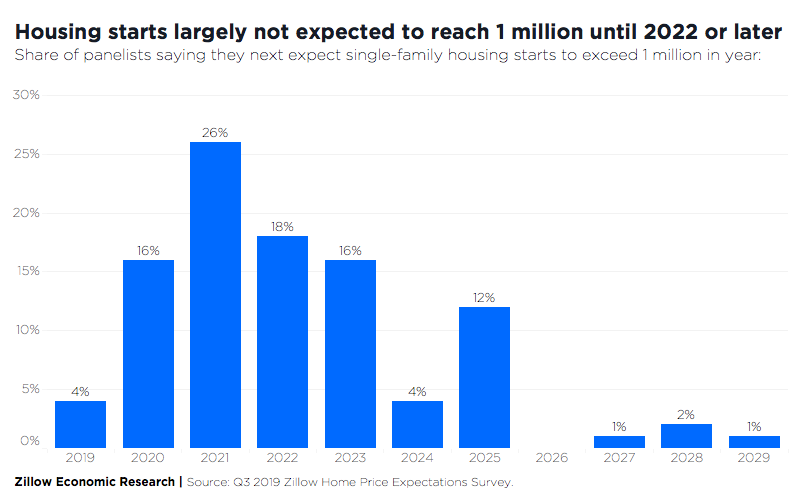

- The average seasonally adjusted annual rate (SAAR) of new single-family housing starts in any given month since 1959 is just over 1 million. But in every year since 2007 the rate has failed to reach that level, and a majority of experts surveyed by Zillow said they don't expect starts to record another seven-digit rate until 2022 or later.

- The most popular potential solutions among panelists to help bump building activity include relaxing local review regulations for projects of a certain size, reducing mandatory minimum lot sizes and easing the land subdivision process for landowners.

- On average, panelists said they expect annual home value growth – currently growing at a 5.2% pace – to slow to 3.6% by the end of this year.

Today's slow pace of single-family home building isn't expected to get back to historic norms until 2022 or later, and expectations for home value growth over the next few years continue to weaken, according to a recent Zillow survey of more than 100 economists and real estate experts.

Since 1959, the average seasonally adjusted annualized rate (SAAR) of new single-family housing starts has been just over 1 million in any given month, reaching heights of more than 1.8 million in a handful of months in 2006, on the eve of the Great Recession. But single-family starts fell off a cliff soon after, and haven't exceeded 1 million (SAAR) in a month since July 2007.

The Q3 2019 Zillow Home Price Expectations Survey, sponsored by Zillow and administered by Pulsenomics, asked more than 100 economists, investment strategists and housing experts for their opinions on when annualized housing starts will next reach one million.[1] Just 1 in 5 panelists with an opinion about this matter (20%) said they expect single-family starts to reach that mark before the end of 2020. More than a quarter of respondents (26%) said it might happen in 2021, the most popular single response year – but taken together, a majority (54%) said the 1 million mark was most likely to be exceeded in 2022 or later.

Research indicates that in recent years, the level of building has fallen well short of what would otherwise be expected to simply keep up with population growth. But builders during that time have had well-documented difficulties ramping up homebuilding activity, grappling with issues related to acquiring buildable land in desirable areas; securing lumber and other materials; and finding enough workers. As prices for these key inputs rise and/or succumb to stretches of volatility, it is increasingly difficult for builders to profitably construct large numbers of homes, especially at price points accessible to low- and middle-income home buyers. Rising local regulatory costs related to permitting, environmental review and/or zoning restrictions often also play a role.

Panelists were asked to select up to three possible solutions that might make building easier, and to rank their selections in order of their expected effectiveness in goosing home building activity. The three most commonly chosen and highest-ranked actions chosen were:

- Relaxing local review regulations for projects of a certain size (chosen by 56% of panelists[2])

- Reducing mandatory minimum lot sizes (38% of panelists)

- Easing the land subdivision process for landowners (38%)

A key factor for builders in determining their own appetite for ramping up activity will be expectations for future home value growth – and panelists are currently more pessimistic on their growth projections over the next few years than they were at the same time last year.

Panelists were asked to project annual growth in the Zillow Home Value Index by the end of this year and through 2023. On average, panelists said they expect annual home value growth – currently growing at a 5.2% pace – to slow to 3.6% by the end of this year and to 2.5% and 2.2% in 2020 and 2021, respectively, before picking up somewhat to 2.65% and 3.4% by the end of 2022 and 2023. Those forecasts are slower than what was expected by the same panel at the same time last year (Q3 2018), when panelists forecast growth of 4.2% in 2019, 2.9% in 2020, 2.6% in 2021 and 2.9% in 2022.[3]

Through the end of this year, the most optimistic quartile of respondents said they expected annual home value growth to stay about the same as it is currently and end the year up 5.45%; the most pessimistic quartile said they expected growth to slow even further, to 2.15%.

[1] This edition of the Zillow Home Price Expectations Survey surveyed 106 experts between July 25, 2019 and August 6, 2019. The survey was conducted by Pulsenomics LLC on behalf of Zillow, Inc.

[2] Responses were also scored by weighting the factors according to the importance-ranking assigned to each factor selected by panelists.

[3] Panelists were not asked to provide a forecast for 2023 annual home value growth in the Q3 2018 version of the Zillow Home Price Expectations Survey.

The post Experts: It May Take Years for Home Building to Get Back to Historic Levels appeared first on Zillow Research.

via Experts: It May Take Years for Home Building to Get Back to Historic Levels

No comments:

Post a Comment