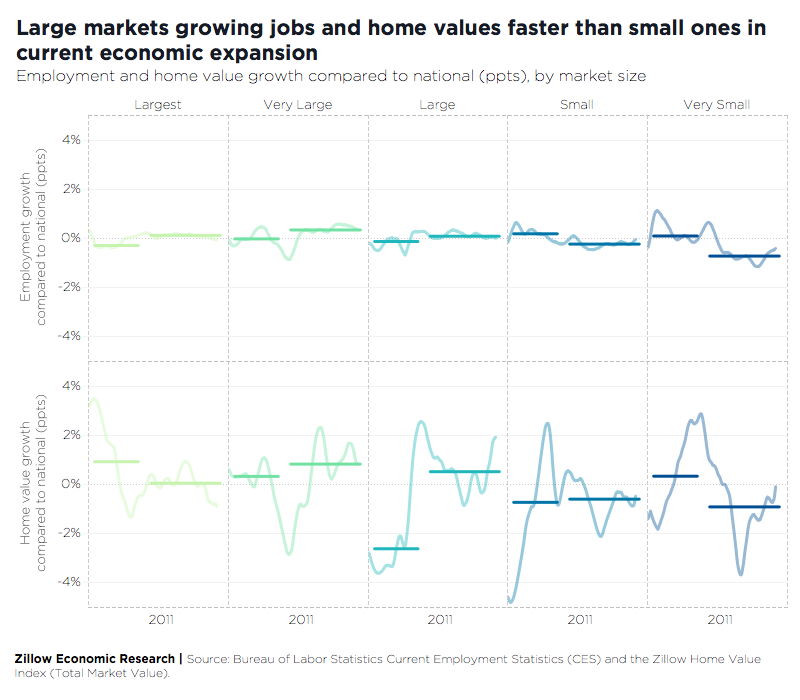

- Throughout this economic expansion, unlike the last, jobs have concentrated in the largest metropolitan areas, with the metros just below the country's top 10 — a group including Phoenix, Riverside, Calif., and Denver — showing the fastest rate of job growth.

- The total market value of homes have followed the same pattern of concentration, but to a greater degree.

- Rural areas posted home value gains, but they made up less of the national increase than in the 00's, echoing their weaker job growth relative to larger markets.

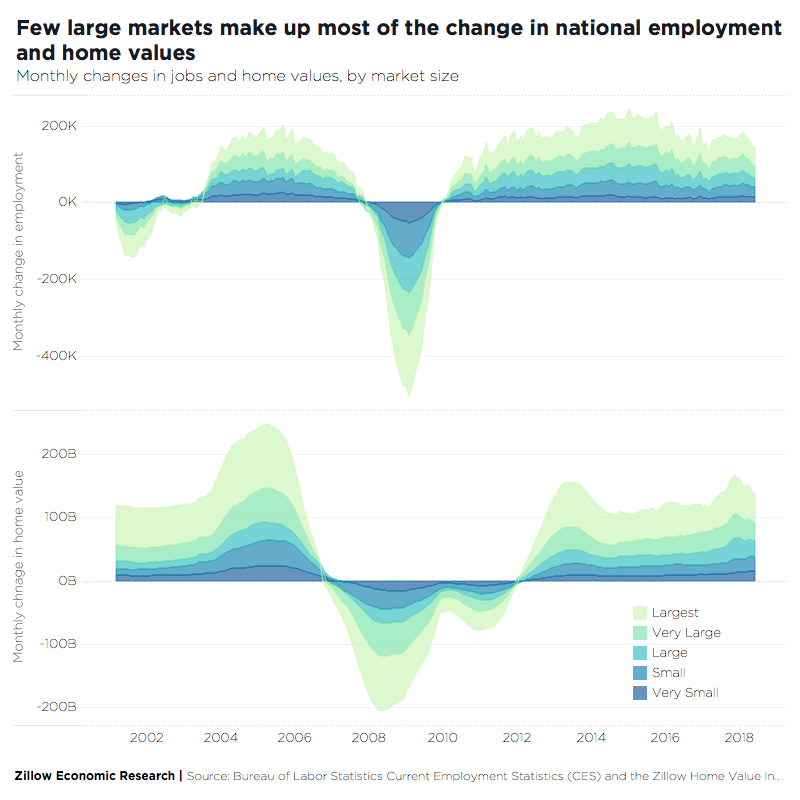

As we passed the height of summer, we also broke records. The U.S. continues through the longest recorded expansion in its history. Payrolls have been growing steadily for about nine years, and that has contributed to a national housing market valued more than 13% above its pre-recession peak, about a 50% increase from the market bottom in February 2012. But those national numbers hide the unevenness of this narrative across the country. Unlike the last expansionary period, which was a boon to rural areas and small markets in terms of job growth, the recovery from the great recession is concentrated in the already very large job centers. The struggle to build and otherwise add housing in large metros means that home value growth is even more concentrated: already expensive metros further outpace their smaller sisters, while people in small metros and rural areas struggle to rebuild equity.

This has been an expansion led by the "very large" markets[1], metros including Seattle, Denver, and Tampa, Fla. All together these markets were responsible for 23% of total U.S home value growth, despite making up only 17.5% of the national market (in terms of dollar value). In the typical month, this means they have collectively been outperforming the nation by 0.8 percentage points[2]. Looking at the full expansion, this amounts to an overall jobs increase that is 7.6 percentage points more than the nation during the same time period. These markets also have been the stars of job creation, adding more than 4 million new jobs and keeping a monthly growth rate 0.3 percentage points faster than the nation.

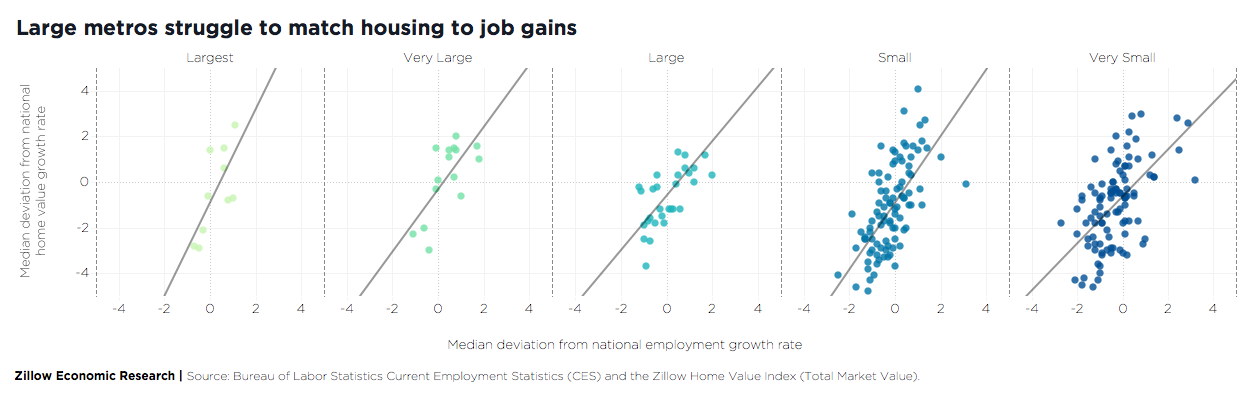

The figure below shows that differences in home value growth track closely with changes in the job market, but are more extreme. Housing stock has been slow to adjust to an inflow of jobs, feeding aggressive home value appreciation in the country's "very large" markets from 2009 to today.

The "largest" metros (New York, Los Angeles, Chicago, Dallas, and San Francisco, among others) are growing in jobs and home values at an average rate just above the national, a big change from their market-leading appreciation of the early 2000's. The middle group of "large" metros, which saw declines in their share of employment and home value during the last expansion, have seen a modest increase in their share of growth since the past decade. However, this is skewed significantly by the boom in jobs and home prices in San Jose, Calif., the largest metro in that group.

While most larger markets have at least grown jobs and home values proportionally to their size, "small" and "rural" markets have not. Before the Great Recession, rural markets especially were matching the pace of the largest metros at fair clip in general. They had the most job growth relative to size and over the course of the six-year expansion from the early- to mid-00s, overall home value growth was 7.1 percentage points higher than the nation (a monthly growth rate 0.3 percentage points faster than the nation). They made up 14.8% of all job creation and 10% of all home value gains. Since the recovery started in 2009, however, this share has fallen to 7% of job creation and 7.1% of home value gains, much less than what would be expected proportionally.

[1] Metros were grouped by ranking of 2018 total non-farm payrolls; Largest [1,10], Very Large [11,25], Large [26,55], Small [56,150], Very Small/Rural [151,].

[2] Based on the median difference from the national annual growth rate for months in the expansion period

The post Small, Rural Markets Left Behind as Large Metros Struggle to Match Housing to Job Gains appeared first on Zillow Research.

via Small, Rural Markets Left Behind as Large Metros Struggle to Match Housing to Job Gains

No comments:

Post a Comment