March 26, 2020

An unfathomably large number of Americans filed for unemployment benefits last week, shattering all-time records. Central banks across the world continued to take unprecedented measures to support the economy. And China began to show some signs of recovery, though risks remain.

-

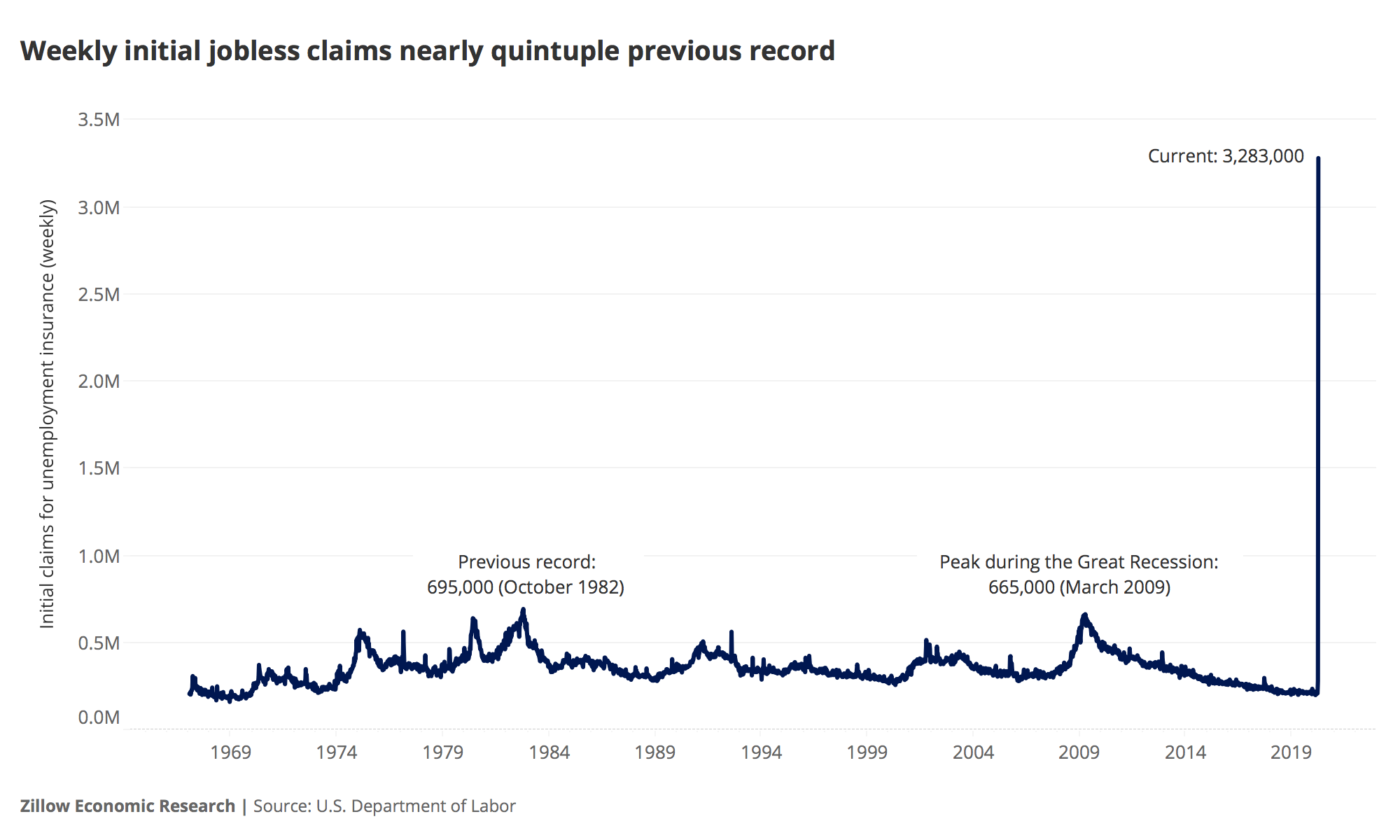

Almost 3.3 million Americans filed for unemployment benefits last week

- The job losses erased about a year and a half of job growth in one week.

- The number of applications was roughly five times more than any other week on record. Just two weeks ago, there were only 211,000 applications for jobless benefits nationwide.

-

Central banks continued to flex their muscles

- The European Central Bank announced a new bond-buying program, with a focus on particularly at-risk economies in the European Union.

- The massive U.S. stimulus bill – largely agreed upon, but not yet law – opens up trillions more dollars that the Fed can extend to borrowers big and small.

-

The U.S. economic slowdown widened

- 46% of builders said they have noticed a "major" slowdown in buyer traffic due to the coronavirus, according to a National Association of Home Builders survey.

- The Kansas City Fed Manufacturing index fell to -17, its lowest reading since April 2009.

So what?

The huge increase in people filing for unemployment benefits last week was unlike anything the labor market has ever seen, and provided one of the first real signs of the economic damage wrought by the coronavirus outbreak. The 3.28 million jobless claims last week shattered the previous all-time record (695,000 in October 1982) and represented the highest reading reached since the financial crisis (665,000 in March 2009). Even more unsettling? These numbers are likely understated. Many people – including independent contractors and workers in the gig economy – don't qualify for unemployment benefits, and many that do might not realize it and thus fail to apply. The surge in applications has wreaked havoc on states' abilities to handle these requests, causing delays and errors that also likely discouraged or even prevented some people from filing their application in time. Looking ahead, it's likely that continuing claims (a count of those who are continuing to receive benefits) will rise next week in the same way that initial claims did today – easily surpassing record levels not seen since the depths of the Great Recession.

Central banks across the world have been very busy in the last couple weeks, taking unprecedented actions in order to stimulate and inject liquidity into financial markets that have been showing severe signs of strain and dysfunction. Following a similar path taken by the Federal Reserve earlier this week, the European Central Bank removed previous limits on its bond-buying program and signaled that it would focus its financial support on Italy and other E.U. countries which have seen their debt obligations swell in the wake of the coronavirus. The move caught investors by surprise and was generally well-received by leaders across Europe, some of whom had been considering more-controversial measures in a desperate attempt to raise capital and ease markets. Meanwhile, the massive U.S. spending bill, which was finally agreed upon in the Senate last night but has not yet been signed into law, includes $454 billion that would backstop any loans the Federal Reserve extends to a wide array of U.S. borrowers. In a rare, nationally televised interview this morning, Fed Chair Jerome Powell stated that "one dollar of…backstop from the Treasury is enough to support $10 worth of loans." So if/when the bill is signed into law, the Fed will have trillions of dollars available to lend on a short-term basis, which many believe they will first be directed towards smaller businesses and state governments on the front lines of the fight.

Several months after initially facing the first widespread coronavirus outbreak, China is showing early signs of improvement and a slow return to some semblance of normal. The daily rate of new coronavirus cases is slowing, and the country now has its lowest total in two months. Reports suggest that people are increasingly encouraged to venture outside, and some industries (factories and stores) are slowly resuming operations. Additional measures of Chinese economic activity – coal consumption and auto sales – are also showing signs of gradual improvement. But waning demand for Chinese goods from markets worldwide has limited China's ability to swiftly recover, forcing firms to cut payroll endangering their ability to offload inventory. These gradual improvements in China invite both optimism and pessimism for recovery efforts in the U.S. and Europe, which have taken more aggressive monetary and fiscal responses but have been less strict in imposing immediate measures aimed at containing the virus's spread. A closer look at upcoming data out of China in coming weeks will provide crucial context for how to evaluate the efficacy of our own efforts thus far, and could inform what our own recovery might look like – and when it may arrive.

The post Zillow Market Pulse: March 26, 2020 appeared first on Zillow Research.

via Zillow Market Pulse: March 26, 2020

No comments:

Post a Comment