- There were 32 million adults living with their parents or grandparents in April, the highest number on record.

- More than 80% of those who recently moved back in with their parents are Gen Zers who pay an estimated $726 million in rent each month. Those payments, about 1.4% of the total rental market, could be at risk if moves home become permanent.

- Among the 50 largest U.S. metros, Oklahoma City, Austin and Nashville have the most exposure to potential rent lost by young adults (aged 18-25) moving back home.

Roughly 2.7 million U.S. adults moved in with a parent or grandparent in March and April as the coronavirus pandemic spread, potentially costing landlords hundreds of millions of dollars in monthly rent payments and casting doubt on the future mobility of young workers in particular if widespread unemployment continues.

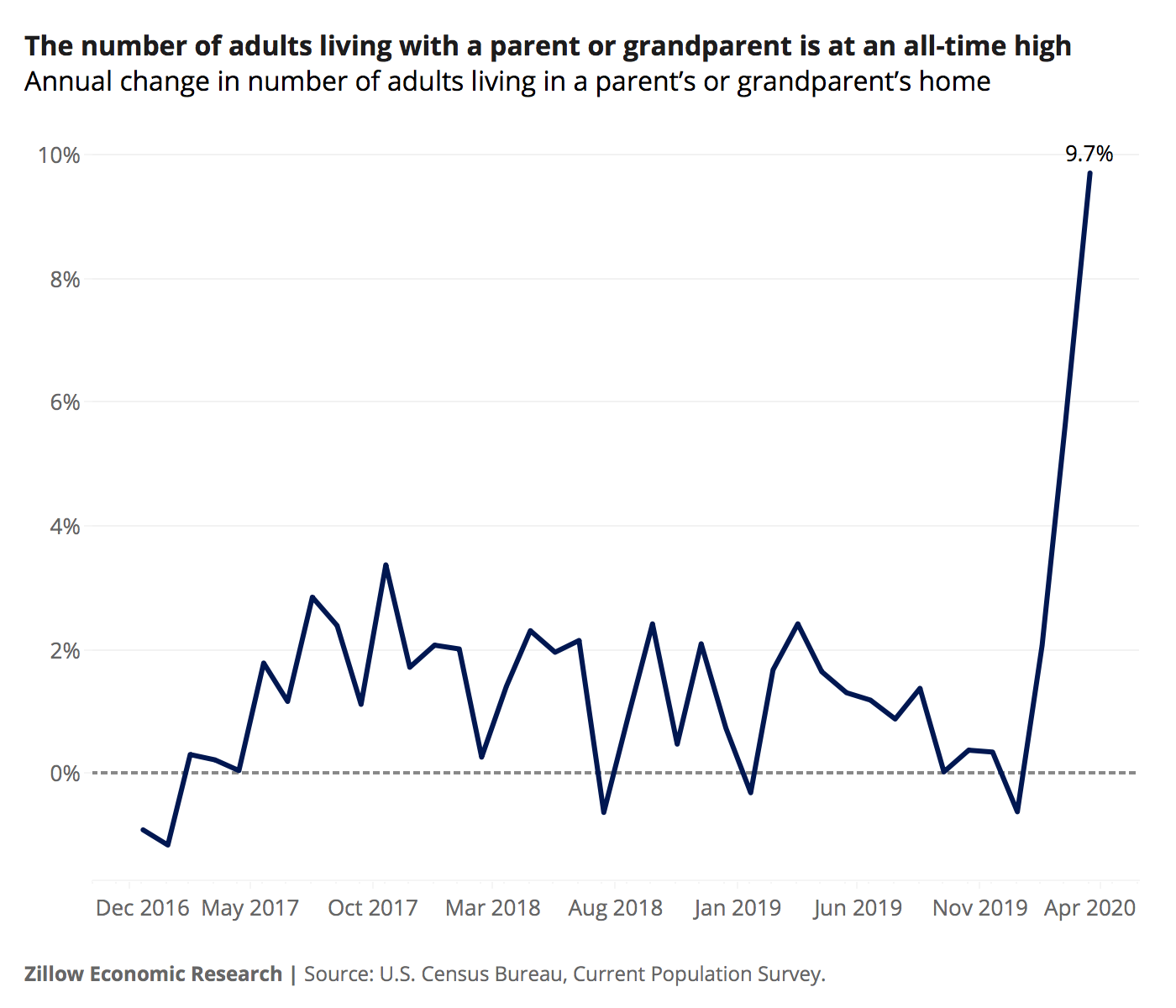

More than 32 million adults lived with a parent or grandparent as of April, according to a Zillow analysis of Current Population Survey data,[1] up 9.7% from the same period a year ago and the highest level on record. A large majority of those who moved home in March and April — about 2.2 million — are from Generation Z, between 18 and 25 years old.

Employment and living situations among this young age group are generally the most in flux even in normal times, and the added uncertainty of the pandemic and future employment prospects makes this group even vulnerable to volatile swings in job and housing markets. Normally, the living arrangements of the 18-25 age group is quite seasonal (because of college terms and/or seasonal work), with a smaller share living at home in the spring months than in the summer months: Typically, 53%-to-55% of these adults live at home in April, compared to 55%-to-57% in July. But this April, that share surged as high as 61%, an unprecedented level.

But while students returning home after the nationwide closure of college campuses this spring is undoubtedly driving some of this surge, young adults were overwhelmingly driven back home by the major labor market swing in the wake of COVID-19. The number of employed young adults (aged 18-25) fell by more than 25%, or 5.9 million, in March and April. Roughly 60% of these workers that became unemployed in these months continued to look for employment, but more than 2 million were officially counted as no longer in the labor force. And while recently unemployed[2] young people moved back home at roughly the same rate as usual (about 60% of them typically live with parents) the total number of them is bigger than ever.

Its not just newly jobless young Americans that are moving back home. Before the pandemic, almost half (46.5%) of employed young adults already lived in a parent's home; by this April, the share had risen to 49%. Those who ceased looking for work altogether or were not in the labor force already, including a large number of students, were even more likely to move back home, adding another million-plus young adults to the ranks of homeward-bound movers.

Rental Market Impact

The housing market itself can't help but be impacted by this huge influx of adults moving back with mom/dad or grandma/grandpa. The large majority (76%, or roughly 10 million) of the 18- to 25-year-olds who do not live with a parent are renters, responsible for approximately $6 billion dollars per month in gross rent. Given that the number of young adults not living with their parents has fallen 12% year-over-year, napkin math gives us a figure of roughly $726 million per month leaving the rental market just from young people moving back home, about 1.4% of the total rental market nationwide. It's important to note that this assumes terminated leases or otherwise unpaid rent across the board, which is very unlikely. But it is a useful starting point to compare potential impacts.

Applying this math across the largest 50 metros in the country, Oklahoma City, Austin and Nashville all appear to have most on the line in this respect, with 1.9% of their local rental markets at stake. Miami, New York, and Los Angeles, with their much larger concentrations of older millennial renters and other older generations are the least exposed to a withdrawal of the youngest group (only 0.7%, 0.8% and 0.9% at stake, respectively).

The flow of young adults away from the rental market is only likely to stop if and when the employment situation improves — and it is discouraging that, as of April, a majority of those who have moved home are not seeking employment. But the fact that many who have moved home are still employed or looking for work will hopefully mean that the rental market impacts described above will not be realized in full. But the world is moving faster than the speed of data, and what was true in April could change with May data as the pandemic continues to wax and wane regionally and local economies tentatively reopen. Surprisingly strong May jobs figures could show that some of those half-million still seeking jobs are finding them, and that conditions may be turning around — potentially pushing more young Americans back out of the nest.

[1] To be considered living in their parent's home a person had to be the child or grandchild of the head of household.

[2] “Recently unemployed” is defined as being unemployed for less than two months. If a person had ceased looking a job for more than a week they were counted as not in the labor force and recency of unemployment was not ascertained.

The post Almost 3 Million Adults Moved Back Home in Wake of Coronavirus appeared first on Zillow Research.

via Almost 3 Million Adults Moved Back Home in Wake of Coronavirus

No comments:

Post a Comment