- LGBTQ+ home buyers are more likely to face a mortgage denial before getting approved and make sacrifices on the home they buy.

- LGBTQ+ renters are more likely to have at least part of their deposits withheld, pay application fees) and experience higher rent increases.

- Many of the challenges faced by LGBTQ+ households in general are even more extreme for LGBTQ+ buyers and renters of color.

As LGBTQ+ people fight for equal footing in the housing market, many still face disproportionate challenges compared to their cisgender, heterosexual peers — especially LGBTQ+ people who are lower-income and/or people of color, according to an analysis of data from the 2020 and 2019 Zillow Group Consumer Housing Trends Reports. These higher hurdles include more difficulty getting a mortgage, finding an affordable home and a higher likelihood of paying extra rental costs.

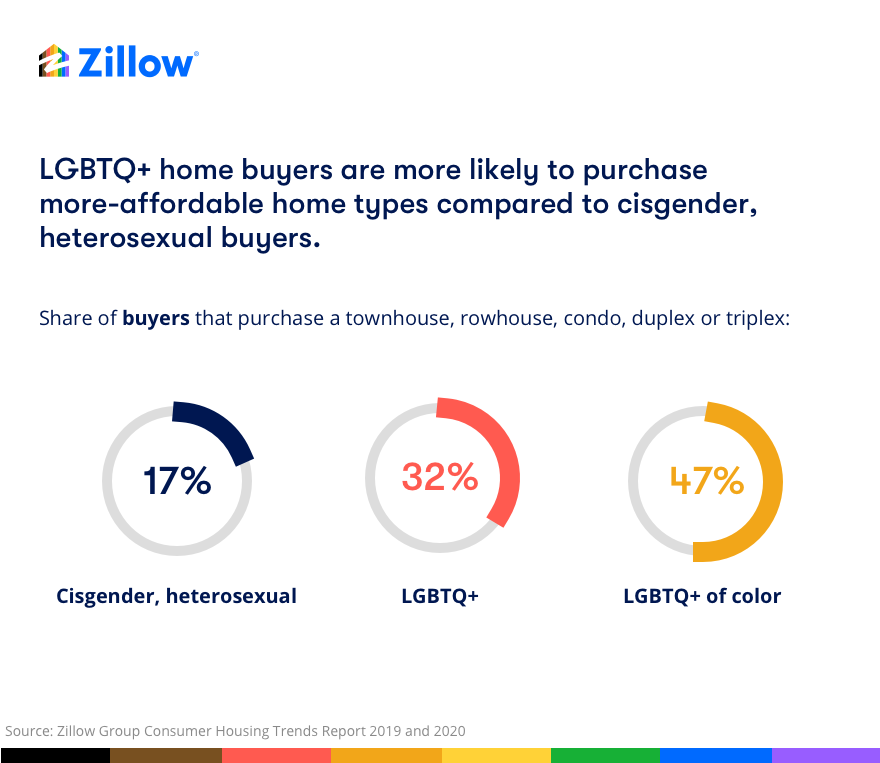

Previous Zillow research found that LGBT home buyers seeking a home in a state, county, or city that affords them legal protections from discrimination in housing and public accomodation can expect to pay $127,000 more than the typical home in a market with neither. This affordability challenge may in part explain why LGBTQ+ buyers gravitate towards more-affordable home types: Almost a third (32%) of LGBTQ+ buyers purchase a townhouse, rowhouse, condo, duplex or triplex, compared to less than 1 in 5 (17%) cisgender heterosexual buyers. Among LGBTQ+ home buyers of color, almost half (47%) end up purchasing these typically more-affordable home types.

But it can sometimes be difficult for buyers to find these types of homes, often because of restrictive zoning that prohibits their development and/or can make it very difficult for builders to construct this type of housing. Considering policies that can boost the availability and accessibility of these more-affordable home types could make homeownership more accessible to LGBTQ+ buyers and LGBTQ+ buyers of color.

Of course, finding a home they want to buy and can afford is only the first step — most LGBTQ+ buyers must then secure a mortgage, presenting another challenge. A third (33%) of LGBTQ+ buyers that take out a mortgage are denied at least once before ultimately getting approved, compared to 19% of cisgender heterosexual buyers with a mortgage. And again, for LGBTQ+ buyers of color the process can be even more challenging: (42%) of LGBTQ+ buyers of color are denied at least once before being approved for a mortgage.

Given these challenges, it is probably unsurprising that LGBTQ+ buyers make more sacrifices to make their deal work. More than two-thirds (70%) of LGBTQ+ buyers report making at least one sacrifice to stay at or below budget, compared to 57% of cisgender, heterosexual buyers, including buying a home that is in worse condition, lacks desired finishes and/or is smaller than initially planned. And more than three-in-four (78%) of LGBTQ+ buyers of color make at least one sacrifice, a far higher share than the 55% of white, cisgender, heterosexual buyers that report doing so.

A Similar Story for LGBTQ+ Renters

Much like their home buying peers, LGBTQ+ renters are also more likely to face higher hurdles when trying to find a home, including withheld deposits, higher application fees and/or bigger rent increases. LGBTQ+ renters that moved from a previous rental are less likely to get their full deposit back: Only 31% of LGBTQ+ renters get their deposit back in its entirety, compared to 40% of cisgender heterosexual renters. The gap widens among racial lines: Only a quarter (25%) of LGBTQ+ renters of color got their entire deposit back, compared to closer to half (44%) of white, cisgender, heterosexual renters.

LGBTQ+ renters overall and cisgender, heterosexual renters are similarly likely to report experiencing a rent increase at their previous rental, but LGBTQ+ renters of color are significantly more likely to experience a rent hike than other groups. Almost all (90%) of LGBTQ+ renters of color who moved from a previous rental say they experienced a rent increase, compared to 76% of cisgender, heterosexual, white renters. And those rent increases are not only more frequent for LGBTQ+ renters of color, they are also more likely to be larger for the LGBTQ+ renter community overall.

Among renters who experienced a rent increase, 44% of LGBTQ+ renters overall and 46% of LGBTQ+ renters of color saw their rent go up by $200/month or more, compared to about a third (36%) of cisgender, heterosexual renters (36%). The average rent increase among all LGBTQ+ renters that experienced one was $81/month more than for cisgender, heterosexual renters. For LGBTQ+ renters of color, the average rent increase was $194/month higher than for white, cisgender, heterosexual renters whose rent went up.

And not only are monthly rent costs often higher for LGBTQ+ renters, upfront rental costs are also heftier. LGBTQ+ renters in general are more likely to pay an application fee (74% do), and LGBTQ+ renters of color even moreso (84% do), compared to 66% of cisgender, heterosexual renters. Total application fees paid by the average LGBTQ+ renter of color ($334) are more than double those paid by white, cisgender, heterosexual renters ($139).

And in the end, there is little payoff for LGBTQ+ renters to having overcome these hurdles and paid these extra costs:, LGBTQ+ renters are less likely to end up in the area in which they originally considered renting (53% vs. 59% of cisgender heterosexual renters). The divide is wider between LGBTQ+ renters of color (42%) and white, cisgender, heterosexual renters (63%). The most common reason that LGBTQ+ renters of color who didn’t end up renting in their initial area cite is that they couldn’t afford the homes for rent in that area (45%) — followed by 36% who said there weren’t many homes to rent in that area.

Looking Back, Looking Ahead

Despite these challenges, state and local governments can take actions to make finding home more equitable for LGBTQ+ households. Policies that legalize and/or pave the way for easier construction of lower-cost, often attached homes (many of which have been championed by LGBTQ+ lawmakers) can add more affordable inventory to markets attractive to LGBTQ+ buyers. Passage of the Equality Act would provide overt housing protections nationwide for LGBT populations; currently, 29 states and the country as a whole do not offer these kinds of legal protections for LGBT people. This Pride month, it's critical to celebrate how far the LGBTQ+ community has come — while also recognizing how much farther there still is to go to achieve true equality.

The post LGBTQ+ Buyers & Renters Face More Challenges, Costs when Searching for a Home appeared first on Zillow Research.

via LGBTQ+ Buyers & Renters Face More Challenges, Costs when Searching for a Home

No comments:

Post a Comment